how much taxes does illinois take out of paycheck

Well do the math for youall you need to do is enter the. Also not city or county levies a local income tax.

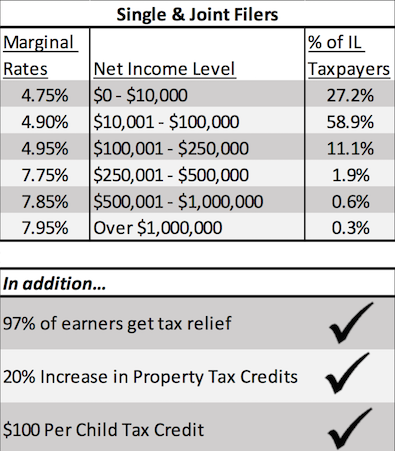

Pritzker Funded Group Concedes Defeat On Illinois Graduated Income Tax Amendment Throwing Future Of State Finances In Doubt R Illinois

For those age 50 or older the limit is 27000.

. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy.

For 2022 the limit for 401 k plans is 20500. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Its important to note that there are limits to the pre-tax contribution amounts. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4.

Employers in Illinois are required to remove 145 percent from each employees paycheck as a state mandated deduction. Overview of illinois taxes illinois has a flat income tax of 495 which means everyones income in. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

Employers can find the exact amount. Unlike Social Security Medicare taxes are levied on all incomes. Generally the rate for withholding Illinois Income Tax is 495 percent.

How much taxes does illinois take out of paycheck Sunday February 27 2022 Edit Each pay period 62 of your paycheck goes to your share of Social Security taxes and 145 goes to. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Illinois Hourly Paycheck Calculator.

Helpful Paycheck Calculator Info. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. For wages and other compensation subtract any exemptions from the wages paid.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. How much is payroll tax in Illinois. It can also be used to help fill steps 3 and 4 of a W-4 form.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. Personal income tax in Illinois is a flat 495 for 20221. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

According to the Illinois Department of Revenue all incomes are created. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. During the course of employment no cash advance repayment agreement can provide a repayment schedule of more than 15 of an employees wages per paycheck.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. How do I calculate how much tax is taken out of my paycheck. W4 Employee Withholding Certificate The IRS has changed the withholding rules.

Illinois Has The Highest Taxes Nationwide Report Finds Mystateline Com

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Illinois Paycheck Calculator Smartasset

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Texas Paycheck Calculator Smartasset Com Paycheck Nevada Calculator

Celebrating America Saves Week 7 Ways To Automate Your Savings Plan Well Retire Well How To Get Money Money Financial Financial Help

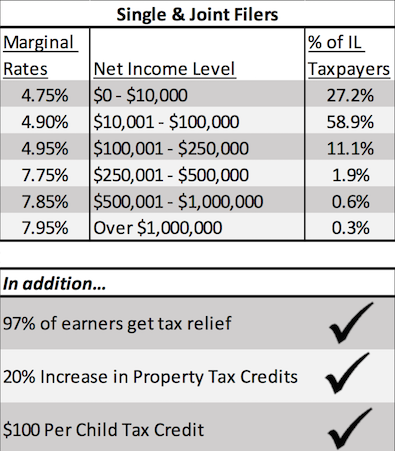

Illinois Working Together Remember Illinois Has A Flat Income Tax Rate That Gives The Wealthiest A Big Tax Break Compared To Our Neighbors Facebook

Where S My Illinois State Tax Refund Taxact Blog

I Have A Monthly Wage Of 1 000 But Need To Pay Tax At 220 So I Just Have 780 In The End Is This Kind Of Tax Rate Common In Illinois Quora

New Tax Law Take Home Pay Calculator For 75 000 Salary

Capitol Fax Com Your Illinois News Radar Mobile Edition

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property

Would Plan To Suspend Gas Tax Help

State By State Guide To Taxes On Retirees Retirement Income Income Tax Retirement